Investment Overview

Investing Today, Shaping Tomorrow

Northfront has moved beyond the traditional investment approaches by considering all aspects of your financial picture and examining how they work together to reduce tax and increase investment returns.

Combining your complete financial picture with our pension-style investing approach, we work to achieve your short, medium, and long-term financial goals. Using pooled funds, our firm gives you access to alternative

investment beyond traditional stocks and bonds. Many individual investors and their advisors may not be set up to take advantage of these opportunities – at Northfront Financial, we are.

Our approach looks to provide you with more diversity in your investments. Our broader strategy includes

investments in infrastructure, real estate, private equity, private debt, venture capital, timber and farmland, and other alternative strategies.

Investment Pools

Diversified Investment Strategy

Private Investments

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Private Investments

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Performance

Investment Pool Performance and Reports

Real Estate

Mortgages

Shares and Equity

High Yield Bonds

Private Equity

Private Debt

Real Estate

Mortgages

Shares and Equity

Bonds

High Yield Bonds

Private Equity

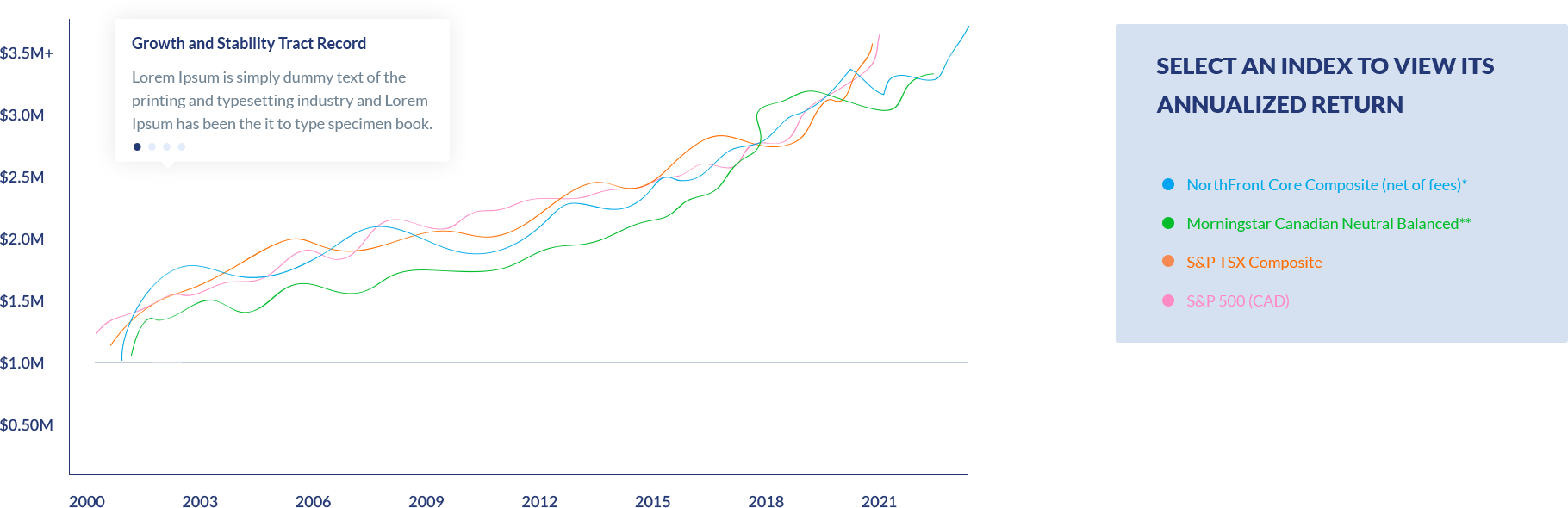

Track Record

Consistent and Good Returns

Funds

Funds Overview and Basics

NorthFront Financial Video Library

Northfront Financial has three pooled funds, structured as mutual fund trusts, for the purpose of managing client assets in a cost-effective manner, while being allocated to help meet client investment goals.

The three pooled funds have different investment strategies; used in combination they provide diversity to client portfolios based on each individual client’s investment objectives, income needs, and risk tolerance.

For more information, contact us today.

Business Basics

Northfront Financial is uniquely positioned to serve emerging and established wealth clients who want a custom, personalized and friendly advising and financial planning relationship. We seek to bring a stable and reliable institutional class experience to our clients.

We bring an independent, investing experience, different than the traditional banking experience, to our clients. Our clients come first; we always do what’s best for them.

Target Market

- Emerging Wealth: approx. $50,000

- Young professionals;

- Individuals with high savings rates and potential for growth over time

- Established Wealth: $500,000 and greater

- Ideal client has $1,000,000 in investable assets

Value Proposition

In a complex investing world, Northfront Financial helps you build financial capacity through

personalized advice and tailored investment opportunities.

Using Northfront Pooled Funds, we offer diversity to clients, including investments in fixed income, equity and alternative assets, at a low cost.